Chase Corporation Announces First Quarter Results | Revenue of $61.9 Million | Earnings per Share of $0.88

Westwood, MA – January 8, 2018 – Chase Corporation (NYSE American: CCF) announces financial results for the quarter ended November 30, 2017.

HIGHLIGHTS – Q1 2018 vs. Q1 2017

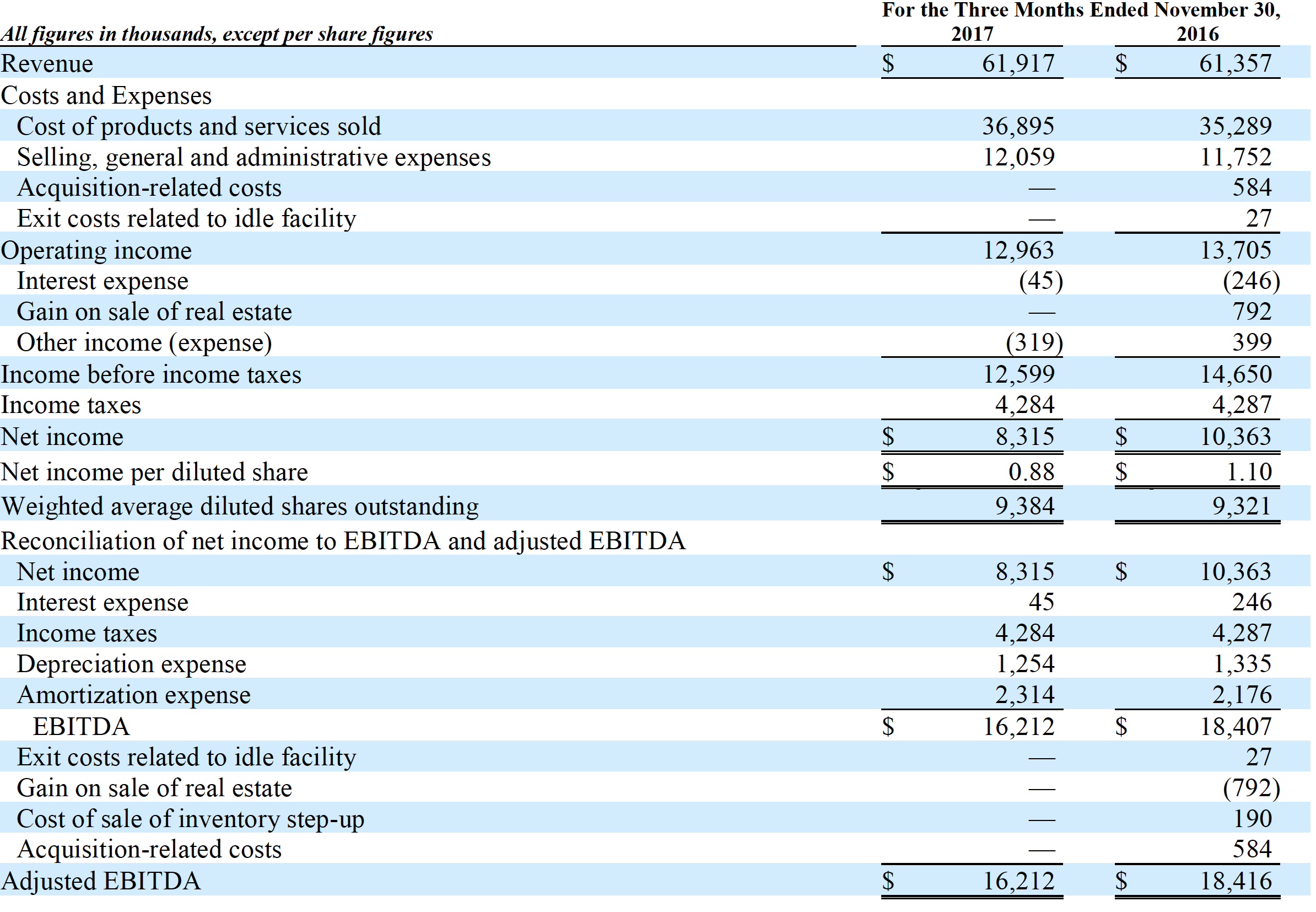

GAAP Financials

- Revenue of $61.92 million, up $0.56 million, or 1%, from $61.36 million

- Operating income of $12.96 million, down $0.74 million, or 5%, from $13.71 million

- Net income of $8.32 million, down $2.05 million, or 20%, from $10.36 million

- Earnings per diluted share (“EPS”) of $0.88, down $0.22, or 20%, from $1.10

Non-GAAP Financial Measures *

- EBITDA of $16.21 million, down $2.20 million, or 12%, from $18.41 million

- Adjusted EBITDA of $16.21 million, down $2.20 million, or 12%, from $18.42 million

* Reconciliations of the Non-GAAP financial measures to Chase’s GAAP financial results are included at the end of this release. See also “Use of Non-GAAP Financial Measures” below.

Adam P. Chase, President and Chief Executive Officer, commented, “We achieved revenue growth over the prior year first quarter, but a less favorable sales mix and the effects of upward price pressures in raw material streams (which were noted in our last earnings release) prevented us from obtaining an operating profit and net income in line with last year’s exceptional first quarter. Gross margin distortion caused by our post-divestiture involvement in certain businesses also affected results. Additionally, certain one-time items in the first quarter of the prior year (the gain on the sale of our Paterson, NJ location, and Resin Designs-related inventory step-up and acquisition-related costs) did not repeat in fiscal 2018. An unfavorable year-over-year swing in foreign exchange and a comparatively unfavorable tax rate were other notable items.

“Maintaining and growing margins and quality of earnings remains our focus,” noted Mr. Chase. “We will address the contracted margins noted this period through internal cost structure rationalization efforts along with external supply chain tactical improvements. We remain focused on our strategic vision with our inorganic growth strategy as a key element for achieving long-term sustainable, profitable growth.

Mr. Chase continued, “Our Industrial Materials segment’s top line grew over the prior year quarter with electronic and industrial coatings and pulling and detection products leading the charge. Favorable trends in the global automotive market have benefited the sales of our HumiSeal® and Resin Designs® branded products, with the electronic and industrial coatings product line obtaining a comparative increase to the prior year. The product line also benefited from having had an additional month of Resin Designs operations in the current year.

Telecommunication infrastructure repair work in Texas and the southeast region of the U.S. following an impactful hurricane season resulted in increased demand for our pulling and detection products. As this repair work winds down, we anticipate continued strong sales on planned infrastructure upgrades. Our cable materials product line did not fare as well as compared to the prior year’s first quarter, and with consolidation and product design changes affecting the industry, there is the potential for this cable materials downturn to continue in the coming period.

“Following the sale of our fiber optic cable components business in April 2017, we have ceased to record further revenue within the product line; however, we continue to provide manufacturing services to the purchaser, which yield a lower overall revenue stream and margin. We have also continued to produce certain wind energy composite materials for the purchaser of the RodPack® business following its divesture in fiscal 2016, recognizing margins below our companywide average for fiscal 2018. Both these post-divestiture arrangements were crucial to solidifying the disposition of the businesses, for which gains were recognized at the time.

“Multiple domestic bridge and highway projects in the New York metro area are using our Rosphalt50® product, making for favorable comparative results for our bridge and highway products. However, certain other product lines within our Construction Materials segment did not fare as well in the first quarter, resulting in an overall reduction in segment revenue period-over-period. Sales of our Rye, UK-produced pipeline coating products into water infrastructure projects in the Middle East continued, but at a greatly muted level to those seen in the past.”

Kenneth J. Feroldi, Treasurer and Chief Financial Officer, added, “Foreign currency transactional gains and losses reversed from a gain in the first quarter of the prior year to a loss in the current year. This swing resulted in an overall negative delta of $0.8 million, recognized within Other income (expense). This change was mainly the effect of the strengthening British pound sterling against the U.S. dollar in the current year.

“Our current quarter effective tax rate was 34.0%, compared to 29.3% recognized in the same period of fiscal 2017. This change in rate further distorts the comparison to Q1 of 2017 results. The period-over-period volatility in our effective tax rate resulted from our continued application of ASU 2016-09, adopted in the first quarter of the prior year. Given the nature of stock option exercise activity in the current quarter, no benefit was recognized in the current quarter. Volatility in our tax rate based on ASU 2016-09 can be expected to continue.

“The passage of the Tax Cuts and Jobs Act of 2017 during our second fiscal quarter is expected to affect the Company’s future results and financial position in multiple ways. For the whole of fiscal 2018, the Company anticipates incorporating in its annual effective rate a blended U.S. tax rate, which will likely cause the rate to be lower than the 34.0% recognized in the first quarter. The new corporate tax rate in the Internal Revenue Code (the “Code”) will also require us to revalue our U.S. net deferred tax asset positions at a presumably lower rate, which will result in a charge taken to earnings in the period this remeasurement occurs. We continue to evaluate and quantify further what effects the new Code will have on our operations and liquidity, including the phasing out of the domestic production deduction (Section 199) and new rules and rates related to the repatriation of foreign cash.”

Mr. Chase also commented, “We recently announced the acquisition of Zappa Stewart effective December 31, 2017. This transaction, which will be accretive in year one, demonstrates continued strategic momentum with our mergers, acquisitions and divestitures program as we build upon our core specialty chemicals expertise, focusing on protective materials for high-reliability applications.

“Our balance sheet remains strong. As of November 30, 2017, the Company’s cash on hand was $54.26 million and our $150 million revolving credit facility was fully available. In December, while a portion of our revolving credit facility was utilized to fund the Zappa Stewart acquisition, from a liquidity standpoint, we still have ample capacity to support both organic and inorganic growth programs to achieve our long-term strategy.”

The following table summarizes the Company’s financial results for the three months ended November 30, 2017 and 2016.

Contact:

Paula Myers

Shareholder & Investor Relations Department

Phone: 508.819.4219

E-mail: [email protected]

Website: www.chasecorp.com

Chase Corporation, founded in 1946, is a leading manufacturer of protective materials for high-reliability applications throughout the world.

Use of Non-GAAP Financial Measures

The Company has used non-GAAP financial measures in this press release. EBITDA and Adjusted EBITDA are non-GAAP financial measures. The Company believes that EBITDA and Adjusted EBITDA are useful performance measures as they are used by its executive management team to measure operating performance, to allocate resources to enhance the financial performance of its business, to evaluate the effectiveness of its business strategies and to communicate with its board of directors and investors concerning its financial performance. The Company believes EBITDA and Adjusted EBITDA are commonly used by financial analysts and others in the industries in which the Company operates, and thus provide useful information to investors. Non-GAAP financial measures should be considered in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP.

Cautionary Note Concerning Forward-Looking Statements

Certain statements in this press release are forward-looking. These may be identified by the use of forward-looking words or phrases such as “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated” and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. To comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company’s business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; rapid technology changes; and the highly competitive environment in which the Company operates. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.