Westwood, MA –July 5, 2018 – Chase Corporation (NYSE American: CCF), a global specialty chemicals company that is a leading manufacturer of protective materials for high-reliability applications, today announced financial results for the quarter ended May 31, 2018, its third quarter of fiscal 2018.

HIGHLIGHTS – Q3 2018 vs. Q3 2017

GAAP Financials

- Revenue of $78.92 million, up $14.02 million, or 22%, from $64.90 million

- Operating income of $16.96 million, up $1.87 million, or 12%, from $15.09 million

- Net income of $13.54 million, up $1.69 million, or 14%, from $11.86 million

- Earnings per diluted share (“EPS”) of $1.43, up $0.17, or 13%, from $1.26

Non-GAAP Financial Measures *

- Adjusted diluted EPS of $1.32, up $0.29, or 28%, from $1.03

- EBITDA of $23.51 million, up $2.71 million, or 13%, from $20.80 million

- Adjusted EBITDA of $22.03 million, up $3.24 million, or 17%, from $18.79 million

HIGHLIGHTS – YTD Q3 2018 vs. YTD Q3 2017

GAAP Financials

- Revenue of $206.71 million, up $23.14 million, or 13%, from $183.57 million

- Operating income of $41.28 million, down $0.43 million, or 1%, from $41.71 million

- Net income of $31.98 million, up $1.38 million, or 5%, from $30.60 million

- EPS of $3.38, up $0.14, or 4%, from $3.24

Non-GAAP Financial Measures *

- Adjusted diluted EPS of $3.29, up $0.37, or 13%, from $2.92

- EBITDA of $56.19 million, up $0.39 million, or 1%, from $55.79 million

- Adjusted EBITDA of $55.54 million, up $1.80 million, or 3%, from $53.74 million

* Reconciliations of the non-GAAP financial measures to Chase’s GAAP financial results are included at the end of this release. See also “Use of Non-GAAP Financial Measures” below.

Adam P. Chase, President and Chief Executive Officer, commented, “Strong sales growth, both organic and inorganic, defined our third fiscal quarter, but so too did the effects of rising raw material prices and their continued pressure on margins in certain areas. We also continued to experience a comparatively less favorable product mix in the period, further curtailing results. Our second quarter acquisition, Zappa Stewart, delivered on the top and bottom lines, producing margins accretive to our relative average. Despite contracted margins on a percentage basis, the growth in overall sales volume in the third quarter produced increased operating income over the prior year. Our overall earnings were also aided by the sale of our structural composites rod business in April, which continued our divestment of non-core businesses, while both providing us with a one-time gain and securing a royalty agreement to provide for future cash inflows.

“Price increases have gone into effect for those products most impacted by rising raw material costs, with more possible in the near term. While these price increases began to stem the negative effects of inflating raw material costs in the third quarter, we anticipate them to more fully take hold in the fourth quarter and into our next fiscal year. Increasing inflationary pressures from higher commodity prices, supply and demand imbalances and tariffs have been felt across the business, most palpably in our Industrial Materials segment.

“Beyond price increases, Chase has also made other moves to address rising costs with tangible progress in our facilities rationalization and consolidation initiative. In June, after the third quarter, we announced the future closure of our Pawtucket, RI manufacturing plant. Manufacturing operations will transition to our Oxford, MA and Lenoir, NC locations. This ties to our strategic need to achieve structural cost reductions where required given market dynamics. The Pawtucket, RI operation primarily services the wire and cable industry with specialty tapes. This industry has continued to experience customer consolidation, and our tactics match the needs dictated by the market.”

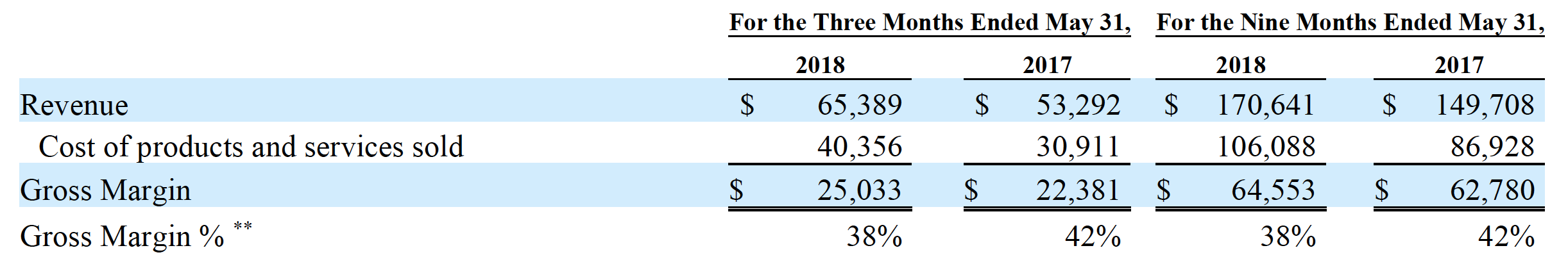

Industrial Materials

**Adjusted for inventory step up, the GM% would be 39% for the nine-month period ended May 31, 2018.

Mr. Chase continued, “The Industrial Materials segment revenue increased over the prior year on a ‘same store’ basis, beyond the additional revenue provided by the newly-acquired superabsorbent polymers business, Zappa Stewart, and offsetting business divestitures. Our pulling and detection and electronic and industrial coatings product lines continued to outpace prior year sales results. With telecom infrastructure build and repair continuing nationwide, and North American and international automotive and appliance use of our products growing, these product lines are poised to continue their success in the fourth quarter. Our cable materials product line surpassed its prior year third quarter results, narrowing the comparable deficit in sales seen in the first half of the year.”

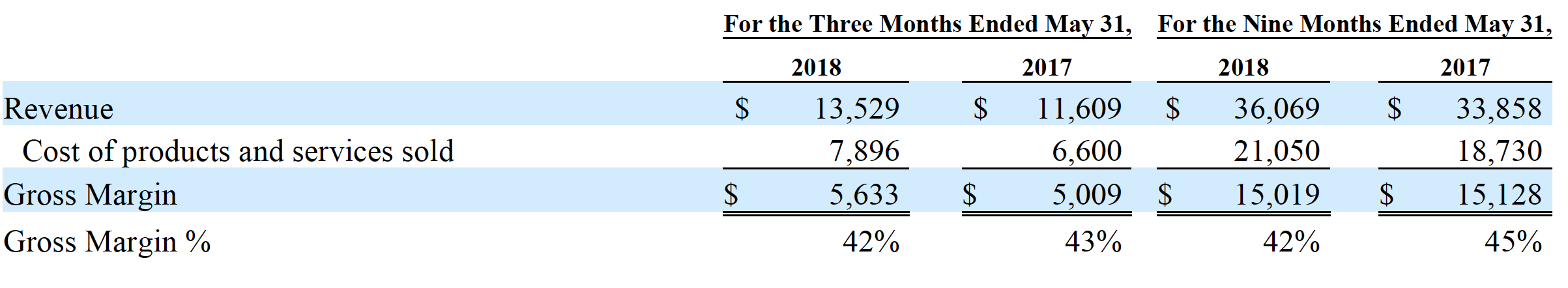

Construction Materials

“Our Construction Materials segment continued the favorable year-to-date momentum gained in the second quarter” noted Mr. Chase. “Middle East sales of water and waste water pipeline products and North American sales of our domestically-produced oil and gas pipeline products grew over the prior year. While our bridge and highway product line could not repeat the results obtained in the prior year third quarter, it remains ahead on a year-to-date basis and is now in the midst of its historically highest sales period. Having effectively addressed cost increases through price increases earlier in the year, the effects of rising raw material costs have not had as dramatic a result on the margins in this segment.”

Other matters affecting financial results:

Kenneth J. Feroldi, Treasurer and Chief Financial Officer, added, “As noted in the second quarter, the effects of U.S. tax reform continued to benefit our Company’s bottom line and overall profitability. The Company recognized an effective tax rate of 27.4% in the quarter, compared to that of 30.7% in the prior year.

“Our tax provision for this quarter did not contain any material changes to those estimates made in the provisional and reasonable adjustments initially recorded in Q2, upon adoption of the new tax code. Additionally, we did not recognize any discrete tax benefit related to stock-based compensation expense resulting from our early adoption of ASU 2016-09. We continue to anticipate that in fiscal 2019 and beyond, aside from any discrete items, that our all-in rate will be approximately 25%, depending on state income tax impact as states adjust to the impact of the new Federal rate.

“Additionally, the quarter saw the reversal of the negative foreign currency transactional trend observed in the first half of fiscal 2018. On a strengthening U.S. dollar, Chase recognized significant foreign exchange gains in the quarter at our Rye, U.K. operations, whose sales transactions are largely denominated in U.S. dollars, nearly fully offsetting losses recognized in Q1 and Q2.”

Mr. Chase also commented, “Our balance sheet remains strong. As of May 31, 2018, the Company’s cash on hand was $33.11 million and our $150 million revolving credit facility had $115 million of additional availability. The Company’s profitable results, cash balance and revolving credit facility continue to enable and empower the Company’s desire to grow both organically and inorganically.”

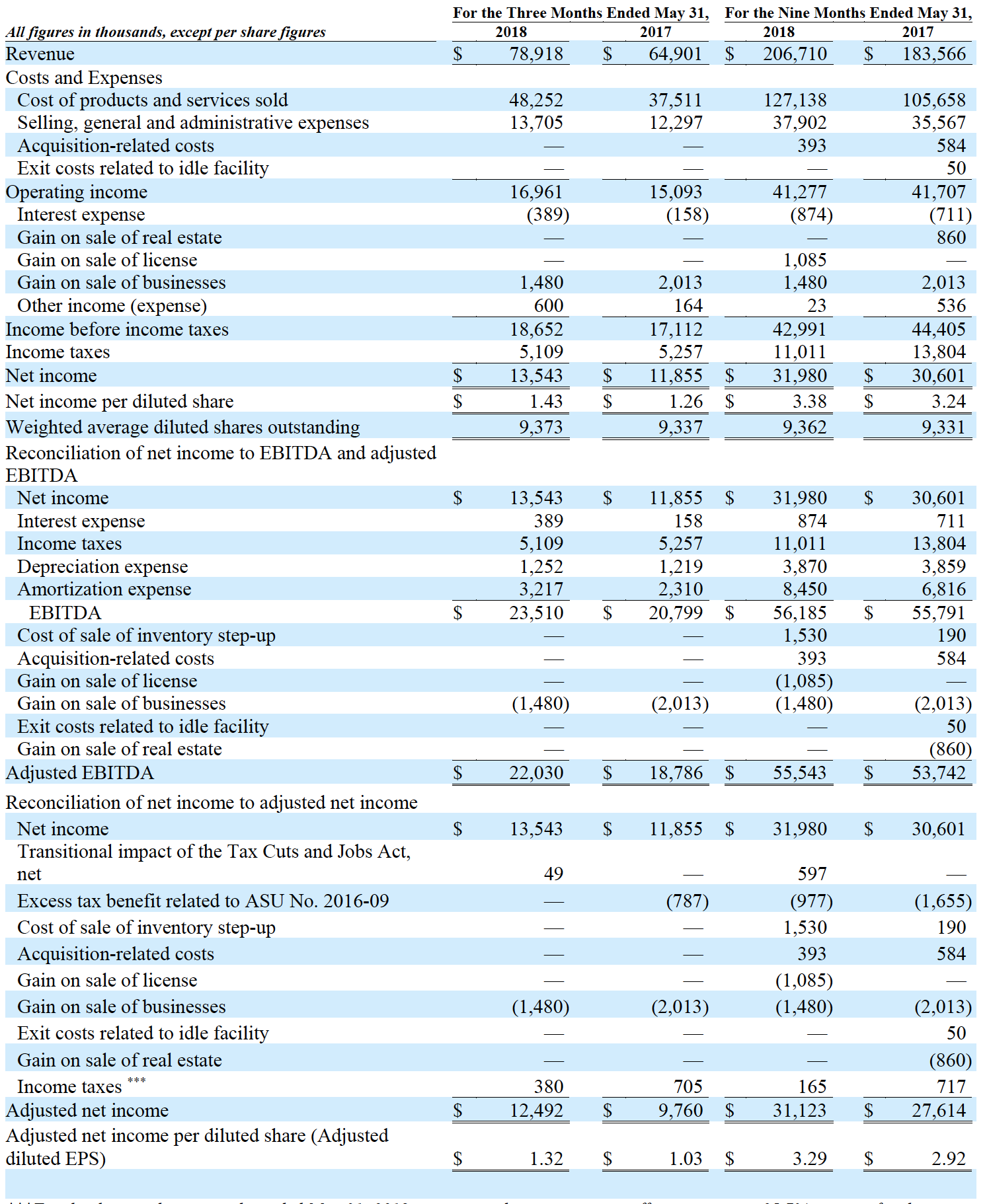

The following table summarizes the Company’s financial results for the three and nine months ended May 31, 2018 and 2017.

***For the three and nine months ended May 31, 2018, represents the aggregate tax effect assuming a 25.7% tax rate for the items impacting pre-tax income, which is our estimated U.S. statutory Federal tax rate for fiscal year 2018 following the enactment of the Tax Cuts and Jobs Act in December 2017. For the three and nine months ended May 31, 2017, represents the aggregate tax effect assuming a 35% tax rate for the items impacting pre-tax income, our then-effective U.S. statutory Federal tax rate.

Contact:

Paula Myers

Shareholder & Investor Relations Department

Phone: (781) 332-0700

E-mail: [email protected]

Website: www.chasecorp.com

Chase Corporation, a global specialty chemicals company that was founded in 1946, is a leading manufacturer of protective materials for high-reliability applications throughout the world.

Use of Non-GAAP Financial Measures

The Company has used non-GAAP financial measures in this press release. Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are non-GAAP financial measures. The Company believes that Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are useful performance measures as they are used by its executive management team to measure operating performance, to allocate resources to enhance the financial performance of its business, to evaluate the effectiveness of its business strategies and to communicate with its board of directors and investors concerning its financial performance. The Company believes Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are commonly used by financial analysts and others in the industries in which the Company operates, and thus provide useful information to investors. Non-GAAP financial measures should be considered in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP.

Cautionary Note Concerning Forward-Looking Statements

Certain statements in this press release are forward-looking. These may be identified by the use of forward-looking words or phrases such as “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated” and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. To comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company’s business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; rapid technology changes; and the highly competitive environment in which the Company operates. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.