Westwood, MA –January 3, 2019 – Chase Corporation (NYSE American: CCF), a global specialty chemicals company that is a leading manufacturer of protective materials for high-reliability applications, today announced financial results for the quarter ended November 30, 2018, the first quarter of its fiscal 2019.

HIGHLIGHTS – Q1 2019 vs. Q1 2018

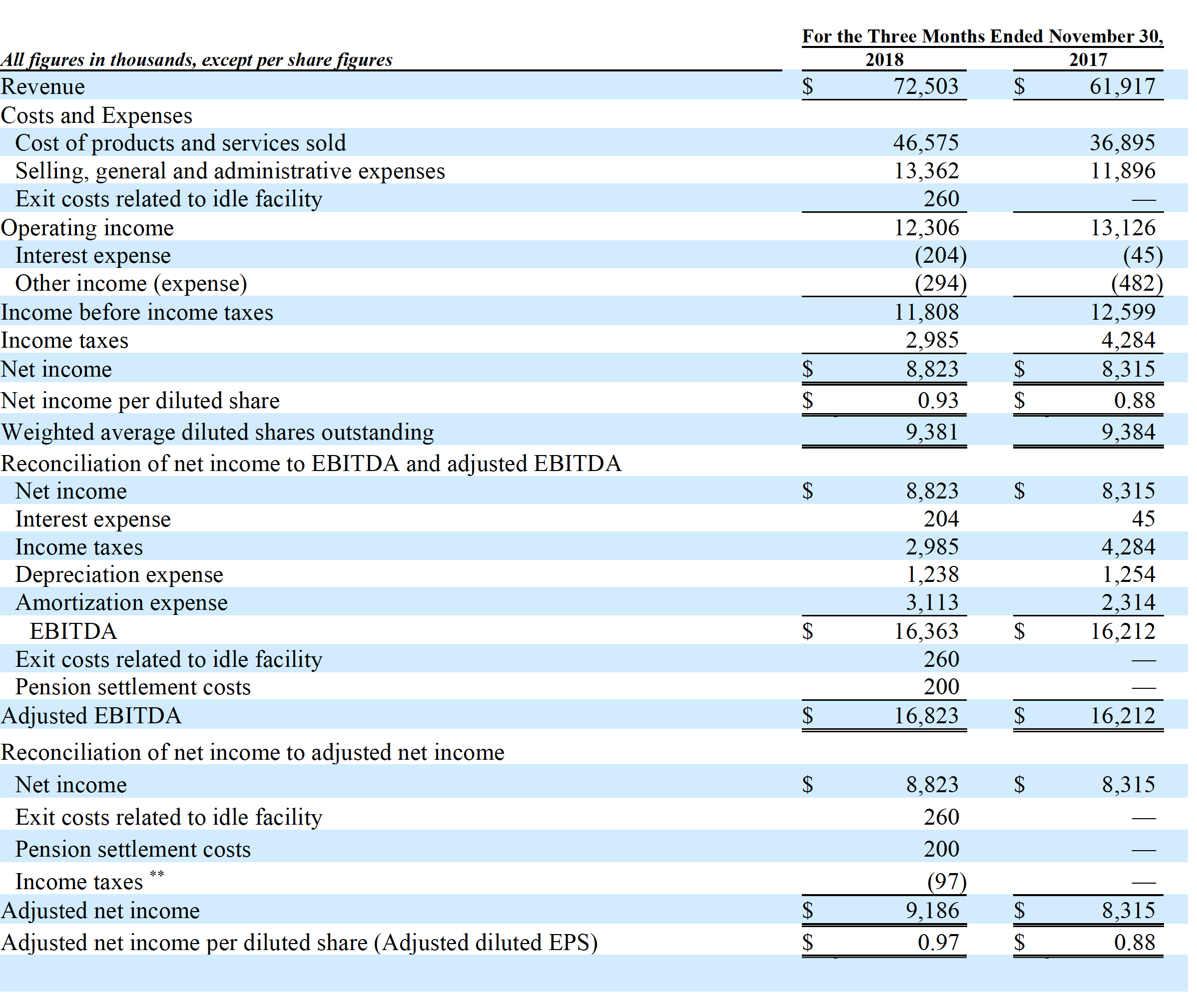

GAAP Financials

- Revenue of $72.50 million, up $10.59 million, what’s the half-life of anavar or 17%, from $61.92 million

- Operating income of $12.31 million, down $0.82 million, or 6%, from $13.13 million

- Net income of $8.82 million, up $0.51 million, or 6%, from $8.32 million

- EPS of $0.93, up $0.05 or 6%, from $0.88

Non-GAAP Financial Measures *

- EBITDA of $16.36 million, up $0.15 million, or 1%, from $16.21 million

- Adjusted EBITDA of $16.82 million, up $0.61 million, or 4%, from $16.21 million

- Adjusted diluted EPS of $0.97 up $0.09, or 10%, from $0.88

* Reconciliations of the non-GAAP financial measures to Chase’s GAAP financial results are included at the end of this release. See also “Use of Non-GAAP Financial Measures” below.

Adam P. Chase, President and Chief Executive Officer, commented, “Revenue growth over the prior year resulted from ongoing organic growth through both increases in volume and price along with the inorganic comparative boost from the Zappa Stewart superabsorbent polymers acquisition.

“We experienced lower than desired operational efficiencies in the first quarter as we worked to integrate the Pawtucket, RI product lines into other facilities following our fourth quarter plant consolidation announcement. This combined with a less favorable product mix and continued raw material cost increases, despite steady progress being made in passing them along in the marketplace, proved to be a drag on our gross margins. The Company has also made certain opportunistic purchases of products anticipated to further increase in price over the short-term, working to create a natural hedge against inflationary pressures. This investment in working capital is planned to be short-term until supply chain and tariff issues are resolved.

“Additionally, we had an increase in our lower-margin custom manufacturing services business during the quarter. This tolling work is performed for the purchaser of both our fiber optic cable components and our structural composites rod businesses. Heading into the second quarter, the purchaser has begun to take on more of the manufacturing themselves, and we anticipate less margin strain from this moving forward.”

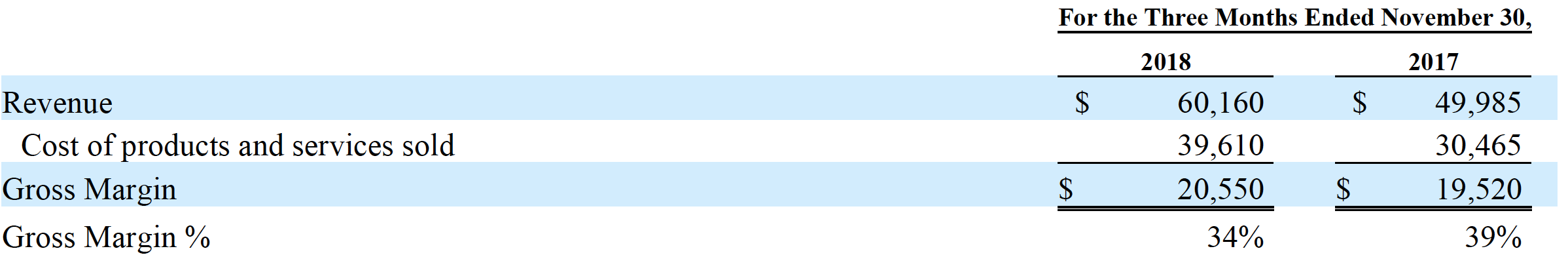

Industrial Materials:

Mr. Chase continued, “Inorganic sales growth from Zappa Stewart accounted for $6.53 million of our Industrial Materials overall growth, while both volume- and price-related organic growth came from our cable materials and pulling and detection product lines. Both legacy businesses benefit from the ever-growing IoT (Internet of Things) which is a driving force behind the growth of telecom and utility infrastructure. Our specialty products business also recognized increases over the prior year, but with lower-margin custom manufacturing services driving a large part of that growth.”

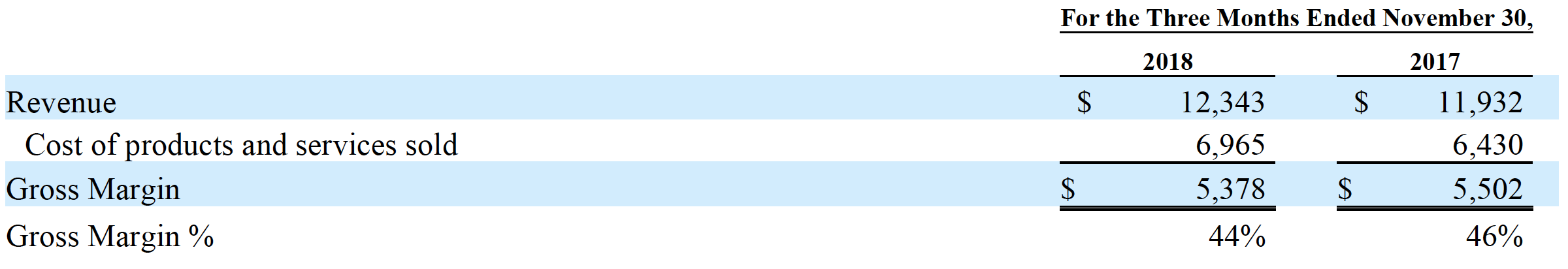

Construction Materials:

“Our Construction Materials segment recognized revenue growth over the prior-year first quarter” noted Mr. Chase. “Volume-driven growth, especially in the western U.S. and internationally, bolstered our coating and lining systems’ top-line results. Our bridge and highway products gained on volume and price increases, with our Rosphalt50® product being utilized in several domestic bridge rehabilitation projects including the Benjamin Franklin (PA), Verrazano (NY), RFK (NY) and Cross Bay (NY) bridges. Our pipeline coatings products did not repeat prior year results for the quarter, on overall tightening credit across the Middle East for water infrastructure project work, as well as slower sales of our domestically-produced oil and gas pipeline products.”

Other matters:

Kenneth J. Feroldi, Treasurer and Chief Financial Officer, added, “In the first quarter of fiscal 2019, we continued to book preliminary and conditional entries related to U.S. tax reform, and we anticipate final and complete entries will be booked in the second quarter. We have entered our first full year under the new Federal tax rates dictated by the Tax Act, and recognized an effective tax rate of 25.3%, as compared to the pre-Tax Act rate of 34% recognized in the prior year period. The reduction in rate came nearly entirely from the Tax Act, as we had no significant discrete items in the current period.

“Benefiting from the flexibility allowed under the Tax Act, we were able to repatriate an additional $10 million during the first quarter of fiscal 2019, with no additional tax effects, and utilized the funds to continue to pay down debt incurred in the prior year to acquire Zappa Stewart.

“On a personal note, I have completed my 28th year with the Company and my 4th year as Chief Financial Officer and Treasurer of Chase Corporation, having spent the majority of the prior two decades in a similar role at our subsidiary NEPTCO. I remain grateful to Adam and Peter Chase and our Board of Directors for the opportunity to serve in this role and am thankful for the dedicated and hard-working associates I have had the pleasure and honor of working alongside. The growth the Company achieved during my time here was rewarding and I was fortunate to have played a role. This past August, Chase welcomed Christian J. Talma into the newly created role of Chief Accounting Officer, and I am pleased with the speed and thoroughness with which he has gained an understanding of the Company and the trust of our associates. Effective with our annual shareholders meeting scheduled for February 5, 2019, and subject to final board approval at that time, Christian will be named Chief Financial Officer, while I will retain the role of Treasurer. Our plan is for me to work closely with Christian through this transition, while remaining an executive officer and employee of the Company.”

Mr. Chase also commented, “Our balance sheet remains strong. As of November 30, 2018, the Company’s cash on hand was $35.52 million and our $150 million revolving credit facility had $135 million of unused availability. Strategic growth initiatives in marketing and product development, along with mergers, acquisitions and divestitures, and operational consolidation will all continue to be our foundation for long-term growth and value creation — and our current financial position puts us on solid footing to execute on these objectives.”

The following table summarizes the Company’s financial results for the three months ended November 30, 2018 and 2017.

** For the three months ended November 30, 2018, represents the aggregate tax effect assuming a 21% tax rate for the items impacting pre-tax income, which is our estimated effective U.S. statutory Federal tax rate for fiscal 2019.

Contact:

Shareholder & Investor Relations Department

Phone: (781) 332-0700

E-mail: [email protected]

Website: www.chasecorp.com

Chase Corporation, a global specialty chemicals company that was founded in 1946, is a leading manufacturer of protective materials for high-reliability applications throughout the world.

Use of Non-GAAP Financial Measures

The Company has used non-GAAP financial measures in this press release. Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are non-GAAP financial measures. The Company believes that Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are useful performance measures as they are used by its executive management team to measure operating performance, to allocate resources to enhance the financial performance of its business, to evaluate the effectiveness of its business strategies and to communicate with its board of directors and investors concerning its financial performance. The Company believes Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are commonly used by financial analysts and others in the industries in which the Company operates, and thus provide useful information to investors. Non-GAAP financial measures should be considered in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP.

Cautionary Note Concerning Forward-Looking Statements

Certain statements in this press release are forward-looking. These may be identified by the use of forward-looking words or phrases such as “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated” and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. To comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company’s business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; rapid technology changes; and the highly competitive environment in which the Company operates. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.