CHASE CORPORATION ANNOUNCES SECOND QUARTER RESULTS REVENUE OF $66.6 MILLION EARNINGS PER SHARE OF $0.56

Westwood, MA – April 9, 2019 – Chase Corporation (NYSE American: CCF), a global specialty chemicals company that is a leading manufacturer of protective materials for high-reliability applications across diverse market sectors, today announced financial results for the quarter ended February 28, 2019, the second quarter of its fiscal 2019.

| SECOND QUARTER | YEAR-TO-DATE SECOND QUARTER |

|---|---|

| Revenue increased 1% to $66.63M | Revenue increased 9% to $139.13M |

| Operating income decreased 31% to $7.92M | Operating income decreased 18% to $20.23M |

| Net income decreased 48% to $5.27M | Net income decreased 24% to $14.10M |

| Diluted EPS decreased 48% to $0.56 | Diluted EPS decreased 24% to $1.49 |

| EBITDA decreased 30% to $11.46M* | EBITDA decreased 15% to $27.82M* |

| Adjusted EBITDA decreased 18% to $14.14M* | Adjusted EBITDA decreased 8% to $30.97M* |

| Adjusted EPS decreased 30% to $0.77* | Adjusted EPS decreased 12% to $1.74* |

* Reconciliations of the non-GAAP financial measures to Chase’s GAAP financial results are included at the end of this release. See also “Use does clen make your muscles bigger of Non-GAAP Financial Measures” below.

Adam P. Chase, President and Chief Executive Officer, commented, “Our second fiscal quarter, traditionally our slowest sales period given the seasonality of certain product lines, proved particularly challenging with continued trade-related headwinds and future uncertainties disrupting normal demand patterns.

“The second quarter revenue increase came from the comparative bump provided by our Zappa Stewart superabsorbent polymers business, acquired during the second quarter of the prior year. However, our companywide revenue mix proved unfavorable compared to the prior year from a margin perspective. During the quarter the Company continued addressing challenges with certain prior acquisitions with both Resin Designs (acquired in fiscal 2017) and the polyurethane dispersions business (acquired from Henkel in fiscal 2015) requiring additional management attention, and in the case of the polyurethane dispersions business a write down in value more fully explained below. ”

The Company improved operational efficiencies sequentially, quarter-over-quarter, in our Oxford, MA and Lenoir, NC locations following the consolidation of our former Pawtucket, RI facility. Given increased year-over-year demand for our cable material products during this time of transition, our operational costs were higher than expected to maintain service levels.

“Further affecting our margins for the quarter, most prominently in our Industrial Materials segment, were prolonged elevated raw material costs, caused by supply and demand imbalances, and further complicated by the shifting positions of both Brexit and China tariffs. As we seek to improve operating margins, price increases continue to be passed along to the market with some not yet fully in effect. To date, the price increases have covered most, but not all, of the unfavorable cost impact. ”

While remaining cash-flow positive, the top line decline in our polyurethane dispersions business observed last quarter continued. Given expected customer demand, especially for those with exposure to the automotive market, and the current valuation placed on the business, we recorded an impairment charge in the period to bring the carrying value in line with its estimated fair value. Chase remains committed to the business long-term, with allocated R&D resources developing and bringing next generation technologies to the market.

“Beyond gross profit and the impairment charge, our income before income taxes was unfavorably affected in the current quarter by increased R&D and amortization expenses (both related to the prior year purchase of Zappa Stewart) and pension-related settlement costs due to the timing of lump-sum distributions, which did not occur in the prior year. The Company also had benefited from a one-time gain on sale of license in the prior year.”

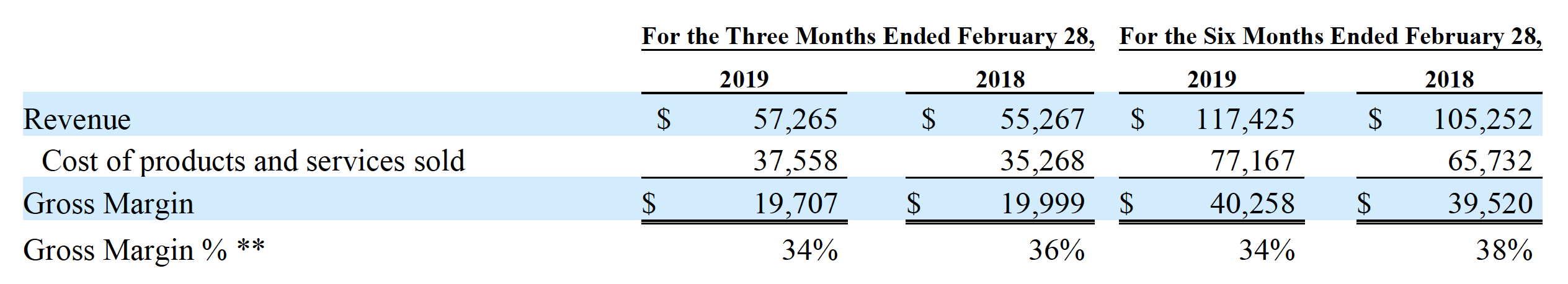

Industrial Materials:

**Adjusted to remove the impact of inventory step up, the GM% would be 39% for both the three- and six-month periods ended February 28, 2018.

Mr. Chase continued, “Zappa Stewart, our superabsorbent polymers business acquired in the prior year, achieved sales growth of $3.02 million over the prior year second quarter, as we enjoyed an additional month of activity in the current year. In contrast, we saw net ‘same-store’ sales decline for the Industrial Materials segment. Following the sales decrease for polyurethane dispersions, which is part of our specialty chemical intermediates product line, the most significant period-over-period decline was seen by our structural composites product line, which recorded no sales in the current year, following its divestiture in last year’s third quarter. During the current quarter, the Company continued to engage in lower-margin custom manufacturing-related services for the buyer of the structural composites business. Our cable materials and pulling and detection product lines positively impacted sales for the quarter with both continued volume- and price-related organic growth. Again, these established businesses capitalized on the ever-growing IoT (Internet of Things) megatrend.”

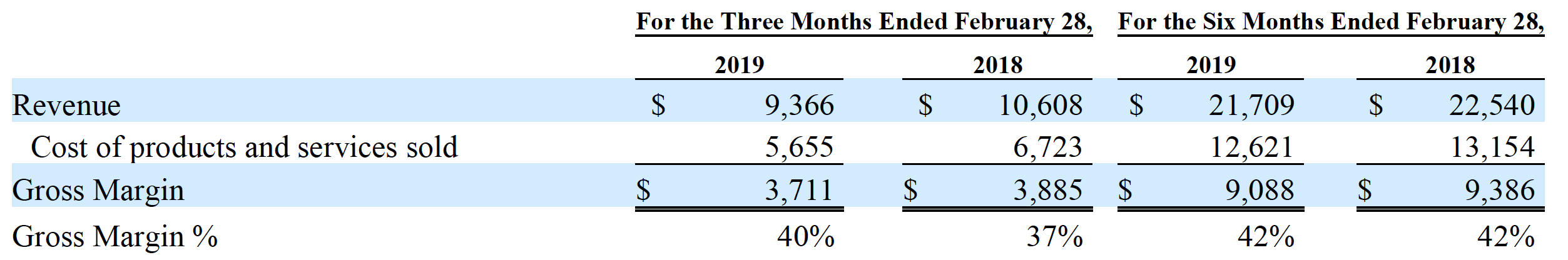

Construction Materials:

“Our Construction Materials segment recognized lower sales for the quarter but was better able to maintain and even improve margins,” noted Mr. Chase. “Our second fiscal quarter brings with it winter seasonality, which negatively affects infrastructure-related project and maintenance work across much of North America. Further, continued tight credit markets in the Middle East tempered water infrastructure project work during the quarter. With its historically best sales periods ahead of it, the segment anticipates significant growth in the next six months over the first half of the fiscal year.”

Other matters:

Christian J. Talma, Chief Financial Officer, added, “In the second quarter of fiscal 2019, we recorded final and complete entries related to our adoption of U.S. tax reform, which were not a material departure from the preliminary and conditional amounts recorded in the second quarter of the prior year. Our recognized effective tax rate of 23.9% for the quarter is in the expected range for future periods, as we had no significant discrete items in the current period. The prior year second quarter rate of 13.8% was not typical, as it was significantly affected by both the initial adoption of the Tax Act and the recognition of a stock compensation-related discrete benefit.

“We continued paying down the outstanding balance on our revolving credit facility, in line with our stated priority of uses of cash. Given the flexibility of the facility, we can de-lever when we have excess cash, but also maintain the purchasing power of the $150 million facility for when an acquisition target is identified.”

Mr. Chase also commented, “Our balance sheet remains strong. As of February 28, 2019, the Company’s cash on hand was $25.09 million and our $150 million revolving credit facility had an outstanding balance of only $6 million. By maintaining our commitment to our tenets for strategic growth we remain poised to capitalize on future opportunities in the second half of fiscal 2019 and beyond.”

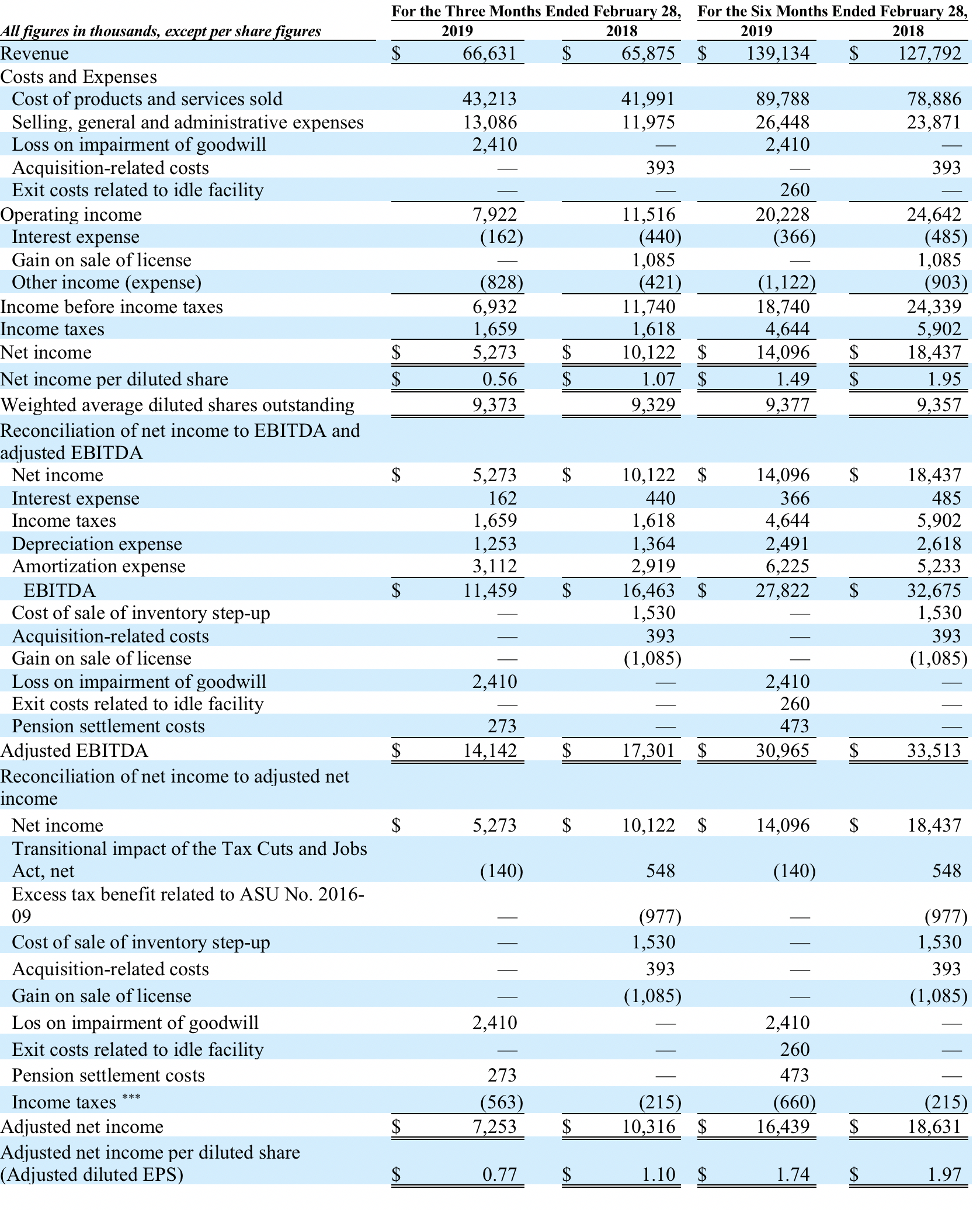

The following table summarizes the Company’s financial results for the three and six months ended February 28, 2019 and 2018.

*** For the three and six months ended February 28, 2019, represents the aggregate tax effect assuming a 21% tax rate for the items impacting pre-tax income, which is our estimated effective U.S. statutory Federal tax rate for fiscal 2019. For the three and six months ended February 28, 2018, represents the aggregate tax-effect assuming a 25.7% tax rate for the items impacting pre-tax income, which was our effective U.S. statutory Federal tax rate for fiscal year 2018 following the enactment of the Tax Cuts and Jobs Act in December 2017.

Contact:

Ruthanne Hawkins

Shareholder & Investor Relations Department

Phone: (781) 332-0700

E-mail: [email protected]

Website: www.chasecorp.com

Chase Corporation, a global specialty chemicals company that was founded in 1946, is a leading manufacturer of protective materials for high-reliability applications throughout the world.

Use of Non-GAAP Financial Measures

The Company has used non-GAAP financial measures in this press release. Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are non-GAAP financial measures. The Company believes that Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are useful performance measures as they are used by its executive management team to measure operating performance, to allocate resources to enhance the financial performance of its business, to evaluate the effectiveness of its business strategies and to communicate with its board of directors and investors concerning its financial performance. The Company believes Adjusted net income, Adjusted diluted EPS, EBITDA and Adjusted EBITDA are commonly used by financial analysts and others in the industries in which the Company operates, and thus provide useful information to investors. Non-GAAP financial measures should be considered in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP.

Cautionary Note Concerning Forward-Looking Statements

Certain statements in this press release are forward-looking. These may be identified by the use of forward-looking words or phrases such as “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated” and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. To comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company’s business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; rapid technology changes; and the highly competitive environment in which the Company operates. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.