Chase Corporation Announces Fiscal First Quarter 2021 Results

Revenue of $67.2 Million, Earnings Per Diluted Share of $1.14

Acquires ABchimie, Proves Immediately Accretive

Realizes Revenue Improvement in International Markets

Westwood, MA – January 7, 2021 – Chase Corporation (NYSE American: CCF), a global specialty chemicals company that is a leading manufacturer of protective materials for high-reliability applications across diverse market sectors, today announced financial results for the quarter ended November 30, 2020, the first quarter of its fiscal year 2021.

Fiscal First Quarter Key Highlights

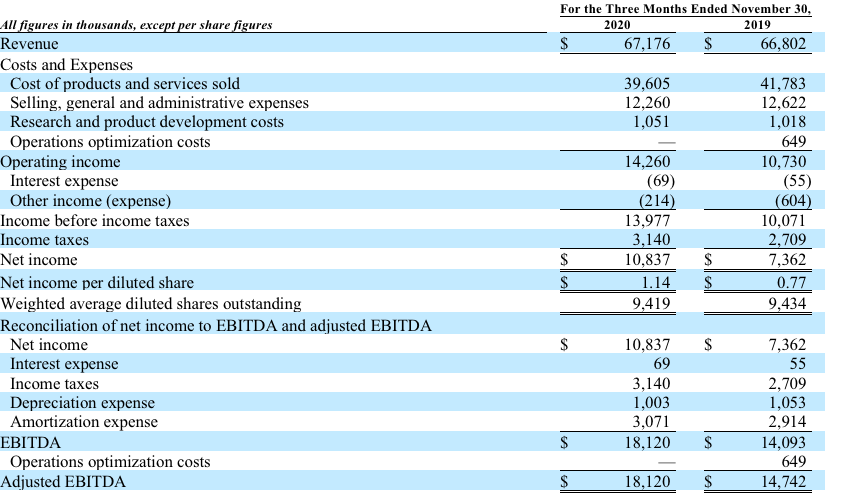

-Total Revenue of $67.2 million, up compared to $66.8 million in the prior year

-Gross Margin of 41%, up compared to 37% in the prior year

-Net Income of $10.8 million, up compared to $7.4 million in the prior year

-Adjusted EBITDA of $18.1 million, up compared to $14.7 million in the prior year

-Free Cash Flow of $13.4 million, lower compared to $17.5 million in the prior year

-Ended fiscal first quarter of 2021 with a cash balance of $90.1 million

-Acquired ABchimie for $22.2 million using cash on hand on September 1, 2020 (fiscal 2021)

“Our first-quarter results demonstrated the resiliency of our business model and solid execution of our core strategic growth drivers,” said Adam P. Chase, President and Chief Executive Officer of Chase Corporation. “The ABchimie acquisition, utilizing our excess cash, provided immediate margin accretion with business integration on track with expectations.” Mr. Chase continued, “We were pleased to experience a strong rebound in Asian demand benefiting our Adhesives, Sealants and Additives segment. Renewable energy-related applications provided an additional boost, not only for this segment but also for our Industrial Tapes segment. However, continued oil and gas market headwinds negatively affected both our Industrial Tapes and Corrosion Protection and Waterproofing segments’ revenue. Helping to counteract these effects on Corrosion Protection and Waterproofing was pent up demand from architectural project delays. Despite the broad-based global effects of the COVID-19 pandemic, all our domestic and international operating facilities remain open, servicing our customers and adhering to CDC and local guidelines.” “Cost structure improvements from last year’s first quarter facility consolidation and ongoing operations optimization efforts helped to drive operational income pull through, producing an Adjusted EBITDA improvement over the pre-pandemic comparative period.” Added Mr. Chase, “I am pleased with our success in continuing to improve gross margin and operating margin while driving strong healthy adjusted EBITDA growth. The growth of our business is directly attributable to the dedication of our employees around the world, whom I am honored to work with and lead through this unprecedented period.”

Fiscal First Quarter Financial Highlights

-Total Revenue grew 1% to $67.2 million, compared to Q1 FY20

-Gross Margin of 41%, compared to 37% in Q1 FY20, due in part to sales mix and operational efficiencies, including site consolidation

-Selling, General and Administrative expenses decreased 3% to $12.3 million from the year-ago period

-Effective Income Tax Rate of 22.5%, compared to 26.9% in the year-ago period

-Net Income for the fiscal first quarter of 2021 was $10.8 million, or $1.14 per diluted share, compared to a Net Income of $7.4 million, or $0.77 per diluted share, for the fiscal first quarter of 2020

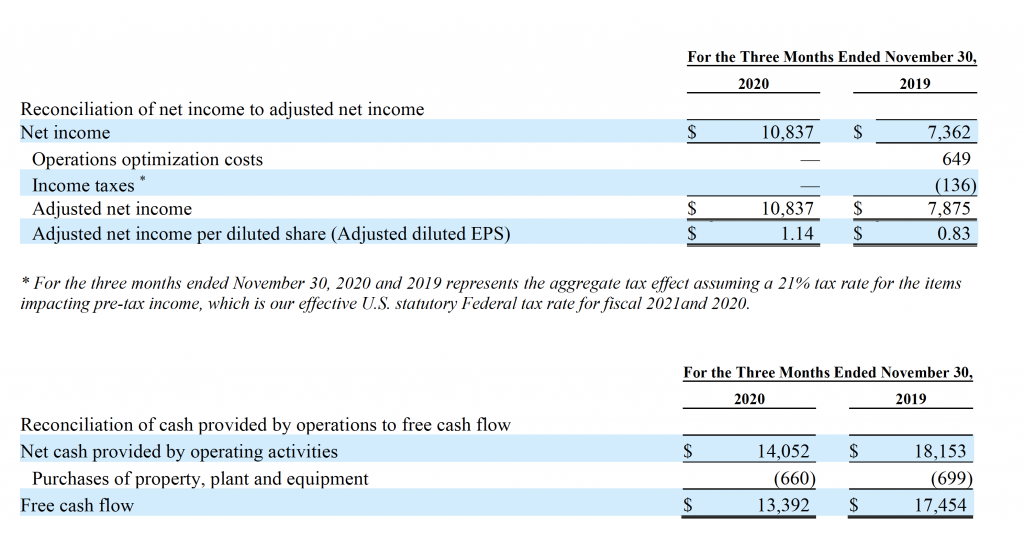

-Adjusted EBITDA for the fiscal first quarter of 2021 was $18.1 million, compared to Adjusted EBITDA of $14.7 million in the prior-year quarter. The reconciliation of Net Income to Adjusted EBITDA is included at the end of this news release

-Free Cash Flow in the fiscal first quarter of 2021 was $13.4 million, compared to Free Cash Flow of $17.5 million in the prior-year quarter

“The strength of our underlying business and ability to capture organic opportunities continues to deliver meaningful cash flow generation and support our overall performance. We are pleased with the early integration of our cash investment to acquire ABchimie and its immediate accretion, and we remain confident this business will further support our international marketing opportunities within the Adhesives, Sealants and Additives segment,” said Christian J. Talma, Treasurer and Chief Financial Officer of Chase Corporation. “We are committed to prudently using our available cash and our credit facility, if necessary, to drive revenue growth across our business while consistently generating meaningful total shareholder returns. Our $150 million revolving credit facility is set to mature in December 2021, and the Company expects to renew this facility prior to its expiration to maintain our ability to support our strategic initiatives.”

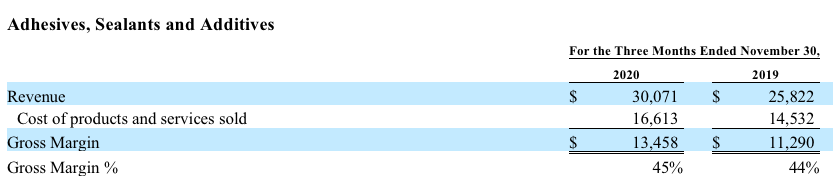

Revenue in the Company’s Adhesives, Sealants and Additives segment increased $4.2 million or 16% in the first fiscal quarter. The increase in revenue was primarily due to a $4.6 million increase in revenue from both organic and inorganic growth in the Company’s electronic and industrial coatings product line. The operations of ABchimie proved immediately accretive to the Company’s results, while strong organic gains were seen internationally. Negatively impacting the segment’s sales was a decrease in revenue from the North American focused functional additives product line totaling $0.3 million in the first fiscal quarter.

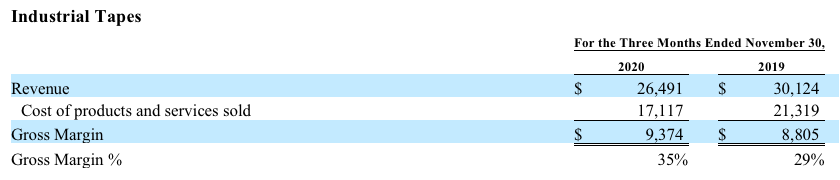

Revenue in the Industrial Tapes segment decreased $3.6 million or 12% in the current quarter. The decrease in revenue was largely due to a volume demand decrease of $2.5 million from the North American-focused cable materials product line; a reduction of $0.7 million for the specialty products product line; a $0.4 million volume reduction from the pulling and detection tapes product line; and an all volume-driven decline of $0.1 million for the electronic materials product line.

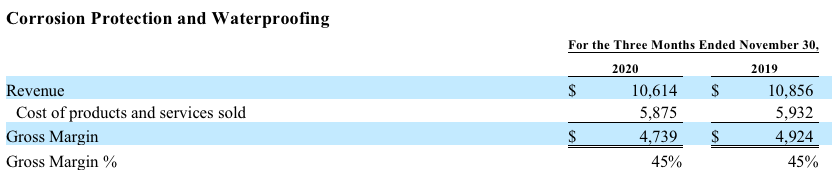

Revenue from the Corrosion Protection and Waterproofing segment decreased $0.2 million or 2% compared to the year-ago period. The decrease was predominantly driven by a $0.5 million decline in the building envelope product line; the pipeline coatings product line’s $0.2 million decrease, which was primarily impacted by a decline in worldwide oil and gas prices; and the bridge and highway product line’s $0.1 million year-over-year volume reduction. The Company’s coating and lining systems product line increased $0.6 million over the prior year, with gains seen in both domestic and international areas. More information on COVID-19 updates can be found at the Company website: www.chasecorp.com

About Chase Corporation Chase Corporation, a global specialty chemicals company that was founded in 1946, is a leading manufacturer of protective materials for high-reliability applications throughout the world. More information can be found on our website https://chasecorp.com/

Use of Non-GAAP Financial Measures The Company has used non-GAAP financial measures in this press release. Adjusted net income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA and Free cash flow are non-GAAP financial measures. The Company believes that Adjusted net income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA and Free cash flow are useful performance measures as they are used by its executive management team to measure operating performance, to allocate resources to enhance the financial performance of its business, to evaluate the effectiveness of its business strategies and to communicate with its board of directors and investors concerning its financial performance. The Company believes Adjusted net income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA and Free cash flow are commonly used by financial analysts and others in the industries in which the Company operates, and thus provide useful information to investors. However, Chase’s calculation of Adjusted net income, Adjusted diluted EPS, EBITDA, Adjusted EBITDA and Free cash flow may not be comparable to similarly-titled measures published by others. Non-GAAP financial measures should be considered in addition to, and not as an alternative to, the Company’s reported results prepared in accordance with GAAP. This press release provides reconciliations from the most directly comparable financial measure presented in accordance with U.S. GAAP to each non-GAAP financial measure.

Cautionary Note Concerning Forward-Looking Statements Certain statements in this press release are forward-looking. These may be identified by the use of forward-looking words or phrases such as “believe”; “expect”; “anticipate”; “should”; “planned”; “estimated” and “potential”, among others. These forward-looking statements are based on Chase Corporation’s current expectations. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for such forward-looking statements. To comply with the terms of the safe harbor, the Company cautions investors that any forward-looking statements made by the Company are not guarantees of future performance and that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or other expectations expressed in the Company’s forward-looking statements. The risks and uncertainties which may affect the operations, performance, development and results of the Company’s business include, but are not limited to, the following: uncertainties relating to economic conditions; uncertainties relating to customer plans and commitments; the pricing and availability of equipment, materials and inventories; technological developments; performance issues with suppliers and subcontractors; economic growth; delays in testing of new products; the Company’s ability to successfully integrate acquired operations; the effectiveness of cost-reduction plans; rapid technology changes; the highly competitive environment in which the Company operates; as well as expected impact of the coronavirus disease (COVID-19) pandemic on the Company’s businesses. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.

Investor & Media Contact: Michael Cummings or Jackie Marcus Alpha IR Group Phone: (617) 982-0475 E-mail: [email protected]

or

Shareholder & Investor Relations Department

Phone: (781) 332-0700

E-mail: [email protected]

Website: www.chasecorp.com

First Quarter 2021 Results PDF

The following table summarizes the Company’s unaudited financial results for the three months and years ended November 30, 2020 and 2019.